ETH News: Top 3 Reasons Why Ethereum Price Can Reach $4,000

Ethereum (ETH) is showing signs of strong recovery, thanks to increased whale accumulation and substantial inflows into Ethereum ETFs. This momentum has sparked renewed interest in ETH price prediction, as these factors could influence Ethereum's price trajectory. Let’s break down the latest developments and what they mean for Ethereum’s price outlook.

Current Ethereum Price Status

- Price Level: Ethereum is trading near $3,220, down 2.5% as of Wednesday as per Coinpedia Markets.

- Supply Dynamics: ETH supply is trending downward, a factor that historically boosts buying pressure and strengthens the bullish sentiment.

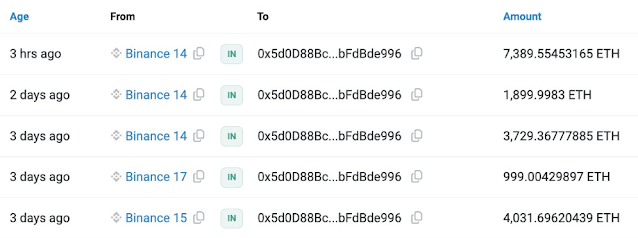

Whale Accumulation Signals Confidence

- Large Whale Activity: According to Lookonchain, a new whale wallet accumulated a staggering 7,389.5 ETH worth about $23.44 million in just four hours.

- Total Accumulation: Over the past three days, the same whale has bought 18,049 ETH, valued at approximately $59.3 million, from Binance.

- Market Impact: Whale accumulation is often viewed as a sign of confidence and has historically coincided with market bottoms, indicating a potential for Ethereum price recovery.

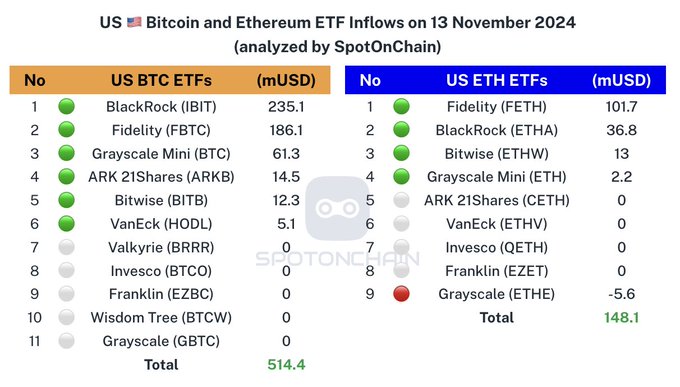

Institutional Demand for Ethereum ETFs Rises

- Record Inflows: On November 13, nine Ethereum ETFs saw a net inflow of 63,701 ETH (about $210.34 million).

- BlackRock’s Contribution: BlackRock alone contributed 39,987 ETH, worth around $132.04 million, increasing its total Ethereum holdings to 569,536 ETH (valued at $1.88 billion).

- Institutional Sentiment: This institutional support underscores growing interest in Ethereum as a long-term investment, positioning ETH as a valuable asset in the crypto portfolio.

Ethereum Price Prediction for Friday

- Price Range: Predictions for Friday place Ethereum’s price between $2,817 and $3,241, with an expected closing around $3,029.

- Outlook: The recent whale accumulation and ETF inflows suggest Ethereum may continue to recover, possibly maintaining its upward momentum in the near term.

Key Factors Supporting Ethereum’s Bullish Case

- Decreasing Supply: A contracting supply typically drives demand higher, supporting price growth.

- Growing Institutional Investment: Increased inflows into Ethereum ETFs show rising institutional confidence in ETH’s long-term potential.

- Whale Accumulation: Large holders accumulating ETH at market dips signals an expectation of future growth, often leading to bullish market shifts.

What’s Next for Ethereum?

- Potential for New Highs: If whale activity and institutional demand continue to rise, Ethereum could be on the path to setting new all-time highs.

- Market Stability Matters: While indicators look positive, broader market trends and macroeconomic factors will also play a role in determining ETH’s trajectory.

The Ethereum market is showing promising signs with the combined influence of whale accumulation and significant ETF inflows. These factors create a supportive environment for ETH’s price recovery, giving investors reason to stay optimistic about Ethereum’s future potential.

.jpg)

Comments

Post a Comment